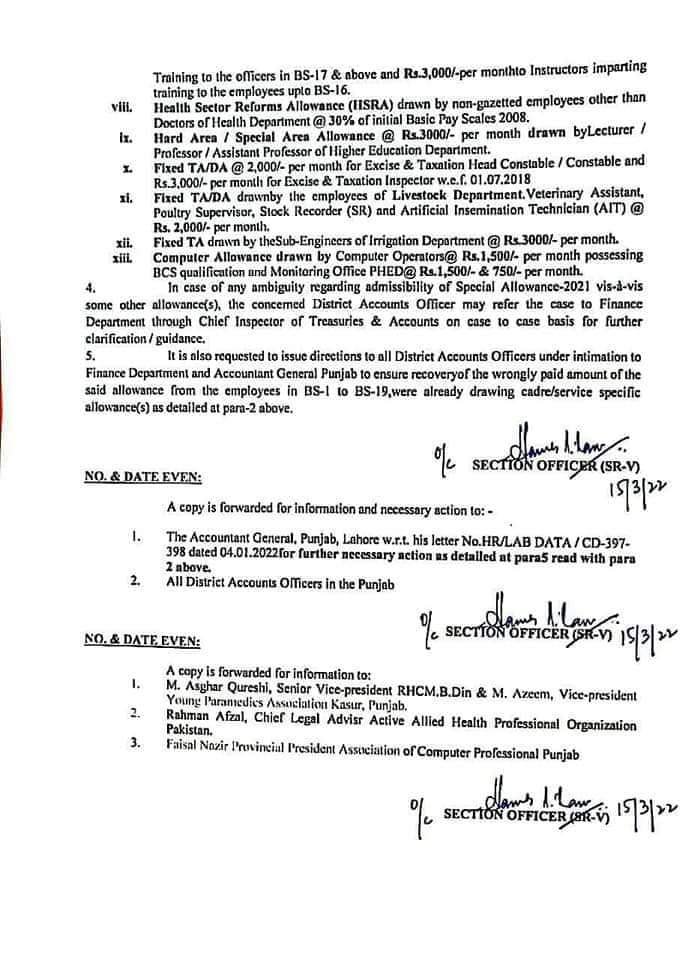

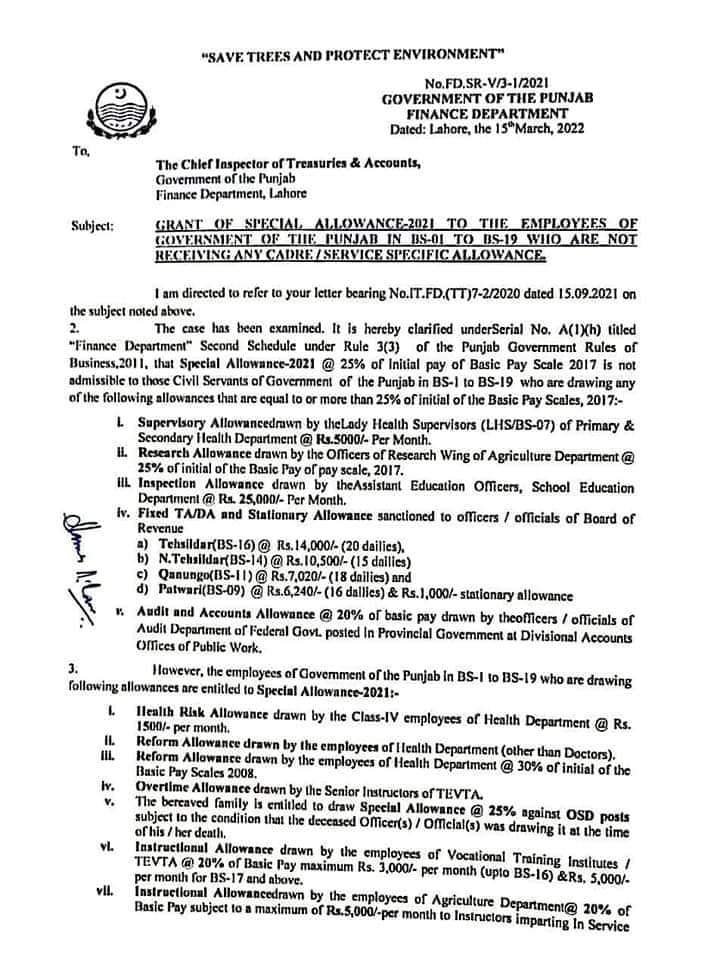

A Notification has been issued on 15-03-2022 in connection with Clarification of Grant of Special Allowance 2021 Punjab Employees BPS-01 to BPS-19 by Government of the Punjab Finance Department.Further detail of said notification in same is as under;

Clarification Grant of Special Allowance 2021 Punjab Employees

I am directed to refer to your letter bearing No.IT.FD.(TT)7-2/2020 dated 15.09.2021 on the subject noted above.

2.The case has been examined. It is hereby clarified under Serial No. A(1)(h) titled “Finance Department” School Schedule under Rule 3(3) of the Punjab Government Rules of Business, 2011, that Special allowance-2021 @ 25% of initial pay basic Revised Pay Scale 2017 is not admissible to those Civil Servants of Government of Punjab in BS-1 to BS-19 who are drawing any of the following allowances that are equal to or more than 25% of initial of the Basic Pay Scales, 2017:-

Who are not Eligible.

- Supervisory Allowance drawn by the Lady Health Supervisors (LHS/BS-07) of Primary & Secondary Health Department @ Rs.5000/- Per Month.

- Research Allowance drawn by the Officers of Research Wing of Agriculture Department @ 25% of initial of the Basic Pay of the pay scale, 2017.

- Inspection Allowance drawn by the Assistant Education Officers, School Education Department @ Rs.25,000/- Per Month.

- Fixed TA/DA and Stationary Allowance sanctioned to officer/officials of Board of Revenue.

- Tehsildar(BS-16) @ Rs.14,000/- (20 dailies),

- Tensildar(BS-14) @ Rs.10,500/- (15 dailies)

- Qanungo(BS-11) @ Rs.7,020/- (18 dailies) and

- Patwari(BS-09) @ Rs.6,240/- (16 dailies) & Rs.1,000/- Stationary allowance

- Audit and accounts allowance @ 20% of the basic pay drawn by the officers/officials of Audit Department of Federal Govt. Posted in Provincial Government at Divisional Accounts Offices of Public Work.

Who are Eligible

However, the employees of the government of Punjab in BS-1 to BS-19 who are drawing the following allowances will get Special allowance 2021:-

- Health Risk Allowance drawn by the Class-IV employees of the health Department @ Rs.1500/- per month.

- Reform Allowance drawn by the employees of the Health Department (other than Doctors).

- Reform Allowance drawn by the employees of Health Department @ 30% of initial of the Basic Pay Scales 2008.

- Overtime Allowance drawn by the Senior instructors of TEVTA.

- The bereaved family is entitled to draw Special Allowance @25% against OSD posts subject to the condition that the decreased Officer(s) / Official(s) was drawing it at the time of his / her death.

- Instructional Allowance drawn by the employees of Vocational Institutes / TEVTA @20% of Basic Pay maximum Rs. 3,000/- per month (up to BS-16) & Rs.5,000/- per month for BS-17 and above.

- Instructional Allowance drawn by the employees of Agriculture Department @ 20% of Basic Pay subject to a maximum of Rs.5,000/- per month to instructors imparting in Service.

- Training to the officers in BS-17 & above Rs.3,000/- per month to Instructors imparting training to the employees up to BS-16.

- Health Sector Reforms Allowance (HSRA) drawn by non-gazetted employees other than Doctors of Health Department @ 30% of initial Basic Pay Scale 2008.

- Hard Area / Special Area Allowance @ Rs.3,000/- per month drawn by Lecture / Professor / Assistant Professor of Higher Education Department.

- Fixed TA/DA @2,000/- per month for Excise & Taxation Head Constable / Consatbe and Rs.3,000/- pe month for Excise & Taxation Inspector w.e.f. 01.07.2018.

- Fixed TA/DA drawn by the employees of the Livestock Department. Veterinary Assitant, Poultry Supervisor, Stock Recorder (SR) and Artificial Insemination Technician (AIT) @ Rs. 2,000/- per month.

- Fixed TA drawn by the Sub-Engineers of Irrigation Department @ Rs.3,000/- per month.

- Computer Allowance drawn by Computer Operators@ Rs.1,500/- per month processing BSC qualification and Monitoring Office PHED @ Rs.1,500/- & & 750/- per month.

You may also like.

- Revised Schedule of Opening of E-Transfer Round School Education Department (SED) Punjab

- Notification Transfer Policy for Teaching Staff 2024 Higher Education Department Punjab

- BISE DG Khan 9th Class Result 2024 SSC Part 1 – bisedgkhan.edu.pk

- BISE Sargodha 9th Class Result 2024 – SSC Part 1

- BISE Lahore 9th Class Result 2024 SSC 1 – biselahore.com

In Case of any Ambiguity

In case of any ambiguity regarding admissibility of Special allowance-2021 vis-à-vis some other allowance(s), the concerned District Accounts Officers may refer the case to Finance Department through the Chief Inspector of Treasuries & Accounts on case to case basis for further clarification/ guidance.

It is also requested to issue directions to all District Accounts Officers under intimation to Finance Depoae\rtment and Accountant general Punjab to ensure recovery of the wrongly paid amount of the said allowance from the employees in Bs-1 to BS-19, were already dawing cadre/service specific allowance(s) as detailed at para-2 above.