A notification has been issued on 25th July 2022 in connection with New Tax Rates on Property Sale and Purchase in Pakistan 2022 FBR by The Government of Pakistan, Revenue Division, Federal Board of Revenue.The new amendment in FBR Sale and Purchase rates on property will be applicable in Islamabad, Balochistan, Punjab, KPK and Sindh. Further detail of said notification in same is as under;

New Tax Rates on Property Sale and Purchase in Pakistan 2022

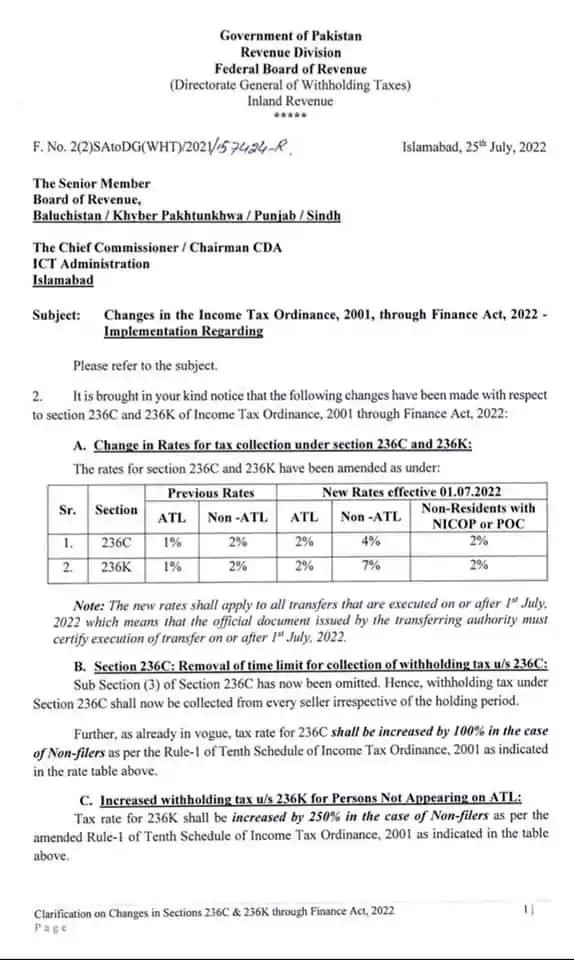

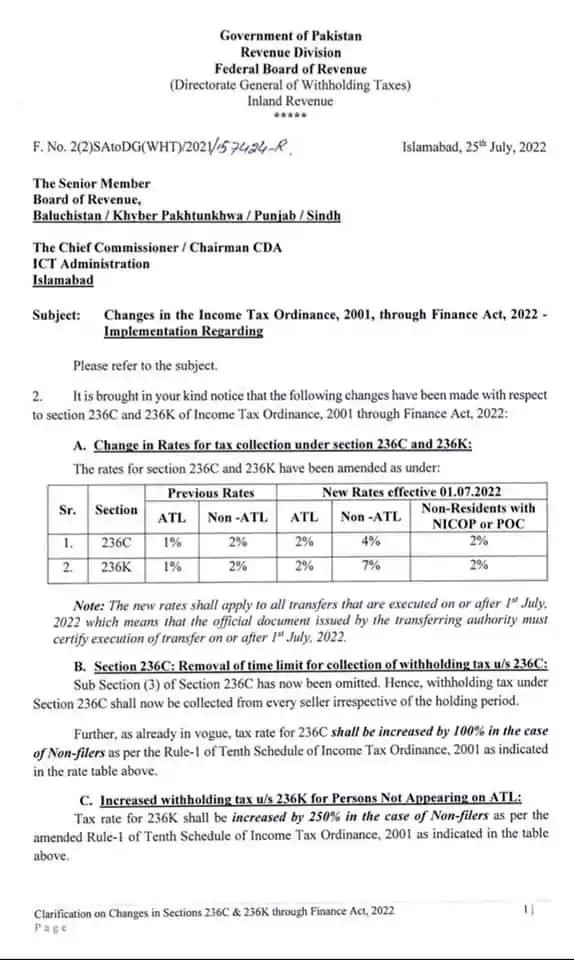

It is brought in your kind notice that the following changes have been made with respect to sections 236C and 236K of Income Tax Ordinance, 2001 through Finance Act, 2022:

Change in Rates for Tax Collection under Section 236C and 236K

The rates for section 236C and 236K have been amended as under:

Note: The new rates shall apply to all transfers that are executed on or after 1st July 2022 which means that the official document issued by the transferring authority must certify execution of transfer on or after 1st July, 2022.

Section 236C: Removal of Time Limit for Collection of Withholding Tax u/s 236C

Sub Section (3) of Section 236C has now been omitted. Hence, withholding tax under Section 236C shall now be collected from every seller irrespective of the holding period.

Further, as already in vogue, tax rate for 236C shall be increased by 100% in the case of Non-filers as per the Rule-1 of Tenth Schedule of Income Tax Ordinance, 2001 as indicated in the rate table above.

Increased Withholding Tax u/s 236K for Persons Not Appearing on ATL

Tax rate for 236K shall be increased by 250% in the case of Non-filers as per the amended Rule-I of Tenth Schedule of Income Tax Ordinance, 2001 as indicated in the table above.