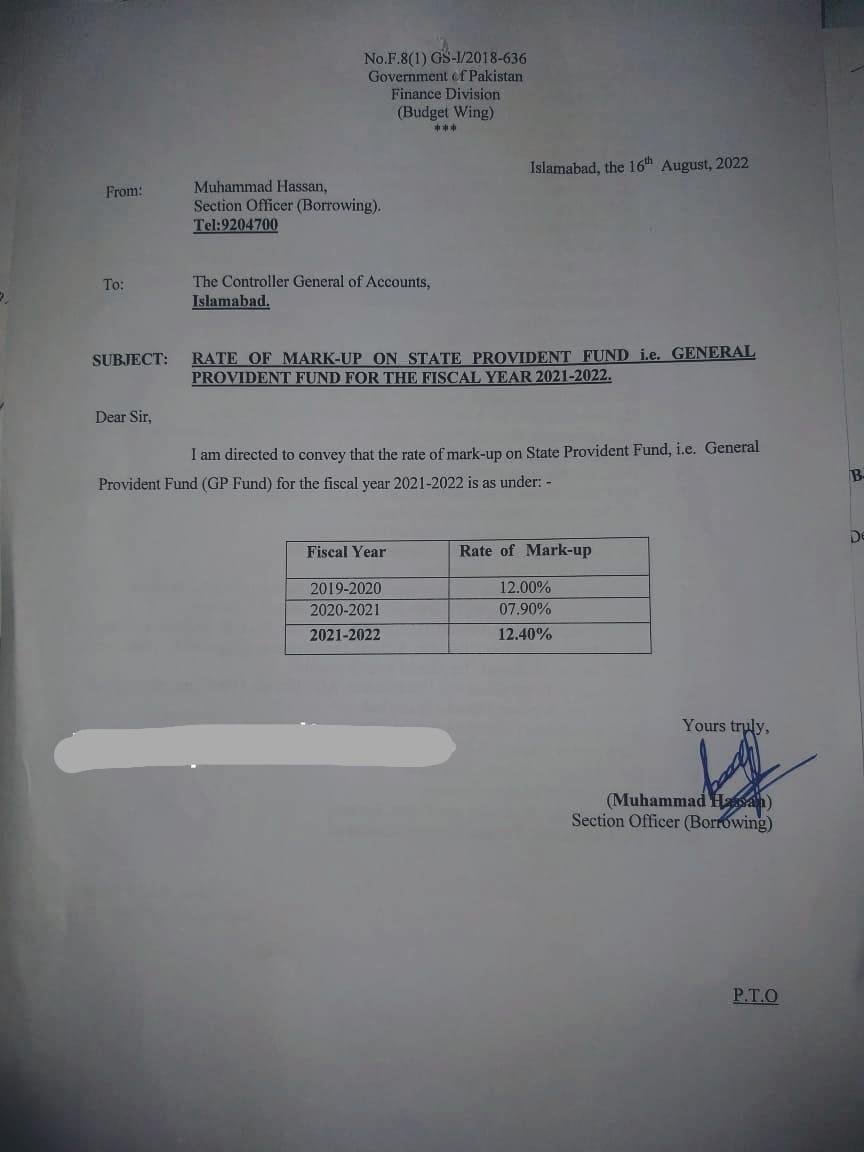

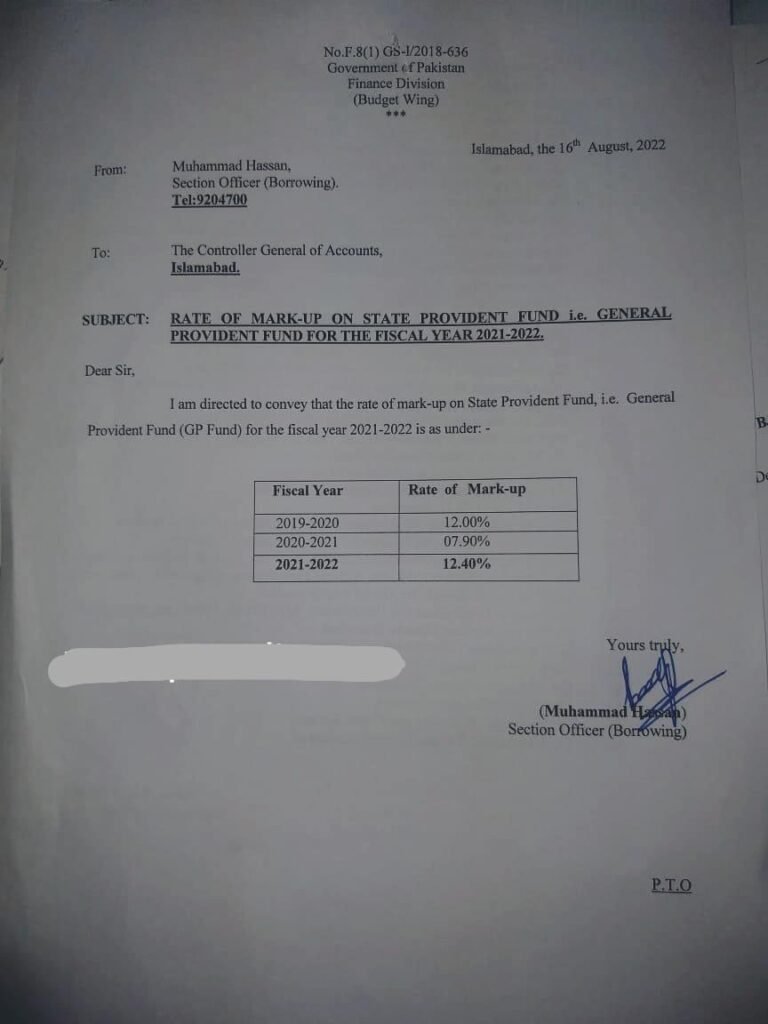

The government of the Pakistan Finance Department has issued the official Notification letter in connection with GP fund interest rates 2022-23 for Federal Government Employees.

According to the letter, the revised Rate of Mark-up on the state Provident fund i.e., the General Provident fund, for the Fiscal year 2022-23 are as under:

Chart of GP Fund Interest Rates 2022

| S.No. | Fiscal Year | Rate of Mark-up |

| 1 | 2018-2019 | 14.35% |

| 2 | 2019-2020 | 12.00% |

| 3 | 2020-2021 | 07.90% |

| 4 | 2021-2022 | 12.40% |

Govt Employees GP Fund Deduction Rate Monthly 2022

| BPS | Old GP Fund Rate | New GP Fund Rate | Difference |

| 1 | 400 | 600 | 200 |

| 2 | 710 | 1059 | 349 |

| 3 | 770 | 1148 | 378 |

| 4 | 830 | 1230 | 400 |

| 5 | 890 | 1324 | 434 |

| 6 | 950 | 1418 | 468 |

| 7 | 1010 | 1498 | 488 |

| 8 | 1070 | 1595 | 525 |

| 9 | 1140 | 1691 | 551 |

| 10 | 1210 | 1795 | 585 |

| 11 | 1290 | 1915 | 625 |

| 12 | 2220 | 3298 | 1078 |

| 13 | 2400 | 3565 | 1165 |

| 14 | 2620 | 3890 | 1270 |

| 15 | 2890 | 4290 | 1400 |

| 16 | 3340 | 4958 | 1618 |

| 17 | 4270 | 6342 | 2072 |

| 18 | 5360 | 7958 | 2598 |

| 19 | 7180 | 10651 | 3471 |

| 20 | 8050 | 11944 | 3894 |

| 21 | 8940 | 13258 | 4318 |

| 22 | 9880 | 14653 | 4773 |

GP Fund Rates History:

These rates of GP Fund Interest 2021-22 are the lowest since 1972. These rates are the lowest after 1972-73. These rates were between 3% and 7.25% before 1972-73. In 1997-98, the highest rate of GP Fund in Pakistan’s history was 22.763. For the same evidence, you can see the GP Fund Interest Rates since 1954.

The markup rates rose initially, reaching a peak of over 22%. They dropped significantly this year. This notification will make employees unhappy if they are receiving interest in their General Provident Fund.

Where Can Employees Use GP Fund Markup:

We can use the recently announced marks-up for many purposes. These rates can be used for the following purposes:

- Calculation of GP Fund Interest for GP Fund Subscription

- Calculation of the Interest on Motorcycle Advance/Motorcar Advance

- To calculate interest on a house building advance

Subscription to GP Funds Interest

The Accounts Office subtracts the GP Fund amount monthly from the pay bills. These rates apply to the GP Fund subscription until June 2022. This rate will not apply to employees who have an Interest-Free GP Fund. This category of employees gets an Interest Free Loan of House Building Advance, Motorcycle/Motorcar Advance. Non-gazetted employees do not pay interest on their HBA.

Calculate interest on a house building advance

Non-gazetted employees or employees who do not get interest on GP Fund will be required to pay no Interest on HBA. They will receive an interest-free House Building Advance.

Gazetted employees, and employees who earn interest on their GP Fund, will be required to pay interest on HBA. The HBA rate for employees who received HBA from 1st July 2021 through 30th June 2022 is 7.90.

Calculation of the Interest on Motorcycle Advance/Motorcar Advance

Employees who receive mark-up on the GP Fund will be required to pay interest on motorcar or motorcycle advances. These rates will use to calculate the Interest of Motorcycle Advance / Motorcar Advance. These advances will be paid interest at 7.90% to employees who received them between 1st July 2021 and 30th June 2022.